Is your company using financial planning for organizational transformation?

Financial planning + Strategic decision-making + Organizational transformation = The essential triad that drives companies to sustain growth and adaptation.

This article examines the complex interplay among these three areas, highlighting how their alignment can catalyze profound organizational change, promote sustainability, and unlock new opportunities for innovation and competitive advantage.

What is strategic financial planning and management?

Strategic financial planning and management are distinguished because they holistically integrate financial aspects into all business decisions, ensuring alignment between financial and strategic goals. Unlike traditional financial planning, which can occur in isolation, this approach requires financial information to inform every aspect of business strategy, from goal setting to execution. It highlights the dual role of finance in managing costs and driving strategic initiatives that drive profitability and growth.

The strategic planning process is how a business determines how to achieve its short- and long-term financial goals. Strategic management aims to ensure a high ROI (return on investment) for the business and its stakeholders in the future.

Strategic financial management is a long-term game. Leaders who embrace this approach may experience losses in the short term, but they are setting the stage for success that can be realized two, five, or even ten years later. This perspective fosters optimism for the future.

What includes an excellent strategic plan?

A good strategic plan is critical to a business’s direction and success. It is a road map detailing the business’s desired future state and strategies for achieving those goals. The plan should include S.M.A.R.T. (Specific, Measurable, Attainable, Realistic, and Time-bound) goals and potential F.A.S.T. (Frequent, Ambitious, Specific, Transparent) goals, depending on the business context.

However, creating a strategic plan is only one part of the equation; understanding your employees is also critical. Research shows that employees usually don’t fully understand their company’s strategy. For example, less than 33% of senior managers understand the connection between corporate priorities, and most employees have differing views on their company’s strategic initiatives. In addition, many enterprises don’t achieve their strategic goals, and many don’t tie financial budgets to strategic priorities.

Companies with written business plans grow faster, and those with strategic plans significantly increase their chances of survival and success.

Use case of financial planning in the organization

An organization’s financial planning use case using an ROI calculator, like the one provided by HRForecast, typically involves assessing the return on investment for specific business initiatives or investments, such as implementing new technologies, hiring strategies, or training programs. Here’s a detailed example focusing on the investment in a new employee training program.

- The primary actor is ABC Corp, a mid-sized enterprise in the technology sector.

- The goal is to assess and maximize the return on investment from a new employee training program that enhances skills and productivity.

Preconditions

- ABC Corp has identified the need for a new training program to keep up with technological advancements and market demands.

- The company can access HRForecast’s ROI calculator and relevant financial and operational data.

- ABC Corp is committed to data-driven decision-making for its investment strategies.

Main success scenario

1. Identification of training program and objectives

ABC Corp identifies a specific training program designed to enhance the skills of its software development team. The primary objectives are to improve productivity, reduce errors, and foster innovation.

2. Data collection

The company gathers all necessary data, including:

3. Using the ROI calculator

ABC Corp inputs the collected data into HRForecast’s ROI calculator to estimate the potential financial return from the training program.

The calculator provides an estimated ROI based on productivity gains, cost savings, and timeframes.

4. Analysis and decision-making

The company analyzes the ROI calculator’s output, considering the projected financial benefits against the training costs. Based on this analysis, ABC Corp decides whether to proceed with the investment, considering the financial return and strategic benefits.

5. Implementation and monitoring

If the decision is positive, ABC Corp implements the training program, closely monitoring its execution and the initial effects on productivity and performance. The company continues to collect data post-implementation to validate the initial ROI projections.

6. Post-implementation review

After a defined period, ABC Corp reviews the program’s outcomes, comparing actual results against the ROI projections.

The company assesses whether the training met its objectives and delivered the expected financial return, adjusting future training investments accordingly.

7. Win-win-win!

Calculate the ROI of your workforce investments

Explore how your company can try HRForecast’s ROI calculator to know:

- The value of strategic workforce planning

- Return on upskilling initiatives

- Benefits of internal recruiting

- Savings on location analysis

- Savings through skills management

How HRForecast can help financial professionals with their financial planning analytics goals

As the cornerstone of strategic business decisions, the HRForecast team is critical in providing leadership with data-driven insights. We specialize in using advanced analytics to improve financial planning and analysis (FP&A) outcomes for finance professionals.

HRForecast transforms traditional data analysis into a dynamic, interactive experience key to making informed decisions.

We offer state-of-the-art solutions that address the nuanced needs of financial experts, allowing them to explore financial data with unparalleled accuracy deeply.

With HRForecast’s robust analytics suite, financial planners can use real-time data and sophisticated forecasting methodologies. It enables them to provide more detailed analysis, increasing the clarity and impact of information presented to key stakeholders such as board members, CEOs, and CFOs.

In what cases are HRForecast solutions a vital ally for your business?

Here are some key features the HRForecast solution can help you with.

Planning and budgeting

HRForecast’s innovative approach to using market intelligence significantly improves financial planning and budgeting processes, offering financial advisors a reliable solution for building more informed and dynamic financial strategies.

By combining multiple data sources, including market trends and financial history, HRForecast provides consultants with a complete perspective, allowing them to anticipate industry changes and allocate resources effectively.

An example of this strategic foresight is their work with Deutsche Bahn AG, where understanding labor market analytics and future job profiles facilitated proactive financial planning, demonstrating the value of aligning workforce information with financial strategies.

Allowing advisors to model different market conditions and assess their potential impact on financial plans helps reduce risk. It facilitates strategic investment and resource allocation decisions, increasing the adaptability and resilience of financial strategies to market dynamics. Based on the HRForecast project with Deutsche Bahn AG, you can see the practical application of market intelligence solutions in directing budget allocations to essential areas such as workforce development and training, ensuring that organizations are well prepared for future market conditions.

Scenario planning

Scenario planning is a crucial element of the HRForecast toolkit, offering a strategic approach that enables financial advisors and HR professionals to anticipate and prepare for various future opportunities. This ability is vital in human resources and financial planning, where market dynamics, regulatory changes, and strategic investment decisions are critical.

By modeling different scenarios, HRForecast helps organizations understand potential effects, identify risks, develop contingency strategies, and skillfully make informed decisions to deal with future uncertainties.

This level of foresight is critical for organizations seeking to maintain resilience and adaptability today.

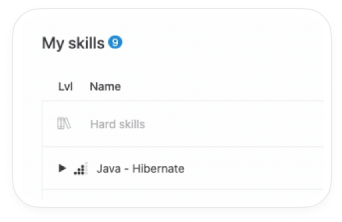

HRForecast’s smartWork, for example, is a robust and versatile application that facilitates strategic workforce planning and skills management. It includes modules such as smartPlan for strategic workforce planning, smartPeople for skills management, and smartLibrary for information storage, which are integrated into a comprehensive framework. Organizations can use these advanced solutions to align their HR strategies with broader business goals, providing a coherent and flexible approach to addressing future challenges and opportunities.

Cash-flow forecasting

Integrating HRForecast’s advanced analytics and HR strategic planning methodology can significantly improve cash flow forecasting in financial management.

Using HRForecast’s approach, as seen in their work with Siemens, these solutions can incorporate macroeconomic data and workforce trends to provide more detailed, predictive financial information.

This integration enables financial advisors to make data-driven decisions, benchmark against industry standards and anticipate market changes, optimize cash flow strategies, and support informed investment, spending, and debt management decisions. Understanding workforce dynamics, such as the evolution of job roles and skill requirements, is critical to forecasting long-term financial commitments, ensuring that financial planning is strategic and aligned with broader business goals.

In addition, the techniques demonstrated by HRForecast for analyzing labor market trends and future skills can be directly applied to improve the accuracy of financial forecasting. By combining financial strategies with workforce planning, organizations can more effectively manage payroll, training costs, and investment in new skills, thus maintaining liquidity and promoting sustainable growth.

Benchmarking financial performance against industry peers and integrating strategic workforce information enable companies to identify potential risks and opportunities, ensuring that financial management is proactive and responsive to market dynamics.

Integrating these comprehensive analytics and planning solutions into cash flow forecasting ensures that organizations are better equipped to make strategic decisions by aligning financial management with business and workforce trends.

Cost reduction

Cost reduction in a firm can significantly benefit from strategic workforce management, where the focus shifts from simply cutting costs to aligning cost savings with organizational growth and employee well-being. Sustainable cost reduction strategies can include optimizing workforce planning, improving skills management, and integrating technology to streamline processes without compromising operational efficiency or employee satisfaction.

Additionally, understanding the financial implications of workforce decisions, such as costs associated with vacancies or the return on investment in employee development, can guide more informed strategic actions. It involves leveraging data-driven insights, which could mean analyzing employee performance metrics, tracking cost trends, or studying market dynamics. By focusing on long-term sustainability and making decisions based on these insights, companies can achieve significant cost reductions that support both near-term financial goals and the organization’s future sustainability.

Find out what cost reduction solutions we have offered for:

and other industries.

Succession planning

HRForecast provides data-driven insights that are invaluable for business continuity planning. By integrating market intelligence, HRForecast helps these companies identify and develop future leaders by aligning talent strategy with the organization’s long-term goals. It helps evaluate internal and external talent, ensuring diverse and competent leadership. HRForecast can enhance strategic financial planning by offering insight into the financial implications of talent, assisting in risk management, and ensuring business continuity and success.

Expansion plans

A manufacturing company might have a strategic plan to expand its operations into a new market. The financial plan, using the data provided by HRForecast, could include estimating the costs of expansion (building or leasing a new facility, hiring new staff, marketing, etc.), forecasting potential revenues from the new market, and outlining funding sources for the expansion (internal funds, loans, equity financing, etc.).

For example, HRForecast helped IAVs exemplify a meticulous approach to site selection for a strategic software initiative. By analyzing labor market conditions, costs, and competitor areas in potential locations, IAV received comprehensive insights, enabling a fact-based decision to establish a new business location. This approach clarified labor market dynamics and associated costs and offered a comparative perspective on adversaries’ and industry’s presence in the selected locations, fostering a strategic advantage.

Merger and acquisition (M&A)

If a company plans to acquire or merge with another firm, strategic financial planning with HRForecast data can include:

- A thorough valuation of the target company

- Determining the financing method for the acquisition (cash, stock, or debt)

- Forecasting the financial impact of the merger

- Planning for integration costs.

HRForecast stands out in the market with its advanced AI and analytics capabilities. It leverages these technologies to streamline M&A success, offering deep workforce insights for informed decision-making. It identifies skills gaps, aids in talent strategies, and enables scenario planning to foresee integration outcomes. Additionally, its predictive analytics anticipate future workforce trends, helping firms prepare strategically. Thus, HRForecast enhances M&A outcomes through focused, data-driven HR interventions.

Reporting and analytics

Providing finance professionals with advanced reporting and analytics, HRForecast increases the clarity and accessibility of financial data through intuitive visualizations and interactive dashboards. It not only simplifies the delivery of complex information to clients, promoting better understanding and engagement, but it also provides professionals with tools for customized reporting and tracking of key performance indicators, facilitating informed decision-making and strategic planning.

Food for thoughts

HRForecast optimizes current operations and paves the way for transformational growth and adaptation to market changes. We provide leaders with the intelligence to make financially sound and strategically aligned decisions, ensuring that organizations can navigate the complexities of today’s business environment with confidence and foresight.

Interested in exploring how HRForecast can integrate into your strategic framework, offering a partnership that improves your financial planning and decision-making processes while driving organizational transformation? Contact our specialists to unlock the full potential of data-driven financial strategy and get practical advice.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810