Optimize your recruitment and reduce the time to fill

Table of contents

- Time to fill vs. Time to hire

- How to calculate time to fill manually: A step-by-step guide

- What data to use to benchmark time to fill at a more micro (role, location) level

- Leveraging future job profiles for enhanced recruitment strategies

- Optimizing recruitment: using job libraries and deep analytics

- Implementation and data utilization

- Summing up

Are you facing challenges streamlining your recruitment process to reduce the dreaded time-to-fill metric? You are not alone.

Finding the right candidate requires not only a clear understanding of the role but also the application of innovative strategies that meet the expectations of today’s job seekers. Below, we’ll explain the concepts of “time to hire” and “time to fill” and help you learn about practical methods, from detailed data analysis to state-of-the-art recruitment practices. In the end, you will receive useful information that will significantly increase your hiring efficiency. But first, let’s demystify the difference between time to hire and time to fill and why getting it right can make all the difference for your organization.

Time to fill vs. Time to hire

“Time to hire” and “time to fill” are pivotal metrics in gauging a company’s recruitment efficiency, illuminating different facets of the hiring process. Though often conflated, understanding their nuances can significantly enhance recruitment strategies.

Time to hire focuses on the candidate’s experience within the recruitment journey. It measures the interval from when a candidate submits their application to when they accept a job offer, providing insight into the speed and efficiency of the hiring process from the candidate’s perspective. On average, in the U.S., this duration is approximately 24 days, as reported by the AIHR. However, some jobs take longer and might take up to 3 months. You might also find the blog post about jobs hard to fill in 2024 insightful.

Formula:

Time-to-Hire = Day candidate accepts the offer – Day candidate enters the pipeline.

Time to fill, however, offers a broader view of the recruitment process. It begins when a job requisition is approved or received by a recruiter and concludes when the new hire starts their position. This metric is vital for understanding the overall timeline and efficiency of filling organizational vacancies. The SHRM’s talent acquisition benchmark report shares that the average time to fill in the U.S. is 36 days.

Formula:

Time-to-Fill = Day candidate starts at the position – Day recruiter receives the requisition.

The relationship between these metrics is crucial; time to hire is a component of time to fill, with the latter encompassing the end-to-end recruitment process, including the candidate’s experience and the administrative and procedural timeframes involved in hiring.

The importance of time to fill

Have you found innovative ways to reduce your time-to-hire or time-to-fill? How do these metrics vary across roles and locations in your organization?

- Efficiency and organizational planning. It reflects the effectiveness of recruiting operations and aids in business and workforce planning.

- Talent pool management. Indicates the organization’s capability to attract and maintain a qualified talent pool, impacting overall business success.

- Candidate experience. Offers insights into the recruitment process from the candidate’s viewpoint, highlighting the efficiency of recruitment technology and methodologies.

- Employer branding. A swift hiring process can enhance an employer’s brand, attract top talent, and maintain market competitiveness.

Role and location-specific data

Recruitment dynamics vary widely across different roles and locations. For example, an analysis featured on HR Forecast highlights how tech roles in Silicon Valley might experience a shorter time to hire due to the dense talent pool. In contrast, similar roles in other regions may see extended hiring timelines due to a need for more qualified candidates.

This disparity underscores the importance of a tailored recruitment approach. Strategies that work in one location or for one role might only be effective in some places. Companies in tech-sparse regions might focus more on developing in-house talent or offering remote positions to widen their talent pool.

HanseWerk, an energy network operator, revolutionized its recruitment process by focusing on advanced analytics and targeted recruitment to optimize time-to-hire and time-to-fill metrics. Key to their strategy was enhancing their employer brand and streamlining candidate experiences, significantly shortening the hiring cycle. Their investment in training HR on new recruitment technologies and methodologies further streamlined the process, demonstrating the impact of a strategic, tech-savvy approach on recruitment efficiency.

Understanding and optimizing both time-to-hire and time-to-fill is crucial for achieving recruitment excellence. These metrics reflect the efficiency of your hiring process and impact your ability to plan for growth, manage recruitment costs, and maintain a competitive edge in the talent market.

Count the ROI of your hiring process

Empower your understanding with the recruitment efficiency Calculator. This tool allows you to input your organization’s data to estimate your time-to-hire and time-to-fill metrics, comparing them against industry benchmarks.

How to calculate time to fill manually: A step-by-step guide

To accurately calculate the time required to fill a position, begin by identifying the start and end points of the hiring process. The starting point can be when a job application is approved, or a job ad is published. Conversely, the endpoint is marked either by the candidate’s acceptance of the job offer or by the candidate’s first day on the job. To determine the time required to fill a position, simply subtract the start date from the end date, making sure you count the total number of calendar days. Maintaining consistency in tracking these dates is critical to obtaining reliable and comparable data across hiring cycles.

Benefits of measuring time to fill

Measuring the time to fill enhances recruitment planning, helps identify process inefficiencies, and realizes potential cost savings. This metric enables organizations to:

- Plan their hiring efforts with greater precision

- Fine-tune onboarding processes for efficiency

- Minimize the financial impact of vacancies.

However, neglecting time-to-fill metrics can burden organizations with significant hidden costs, as long-term vacancies not only reduce apparent savings, but also result in lost productivity, innovation and competitive advantage. Additionally, not having the necessary skilled personnel can impair team effectiveness, project quality, and customer satisfaction, risking a cycle of increased turnover and lost revenue.

A well-managed recruitment timeline improves the candidate’s experience by ensuring timely communication and boosting their interest and engagement with the organization.

Benchmarking your organization’s time to fill against industry or regional averages provides valuable insight into your staffing efficiency. It’s essential to recognize that various factors, including the complexity of the role and the specific industry, can significantly affect the time it takes to fill positions. So, when comparing your performance against these benchmarks, consider these variables to ensure a fair assessment.

What data to use to benchmark time to fill at a more micro (role, location) level

Benchmarking time to fill at a more micro level requires a detailed and nuanced data collection and analysis approach. To accurately assess and compare time-to-fill metrics across different roles and locations, you should consider the following data points and factors:

Role-specific data:

- Job title and description: Clearly defined roles and responsibilities help in making accurate comparisons.

- Skill level required: Differentiating between entry-level, mid-level, and senior-level positions.

- Industry and sector: Time-to-fill can vary significantly between industries (e.g., tech vs. healthcare).

- Specialization: Roles requiring highly specialized skills often have longer time-to-fill metrics.

Location-specific data:

- Geographical region: Urban vs. rural areas and specific cities or regions.

- Labor market conditions: Local unemployment rates, skilled professionals’ availability, and talent competition.

- Economic factors: Cost of living, average salary levels, and employment rates influencing job attractiveness.

Recruitment process data:

- Sourcing channels: The effectiveness of different sourcing methods (e.g., job boards, social media, recruitment agencies).

- Application numbers: The number of applicants for the role can influence the length of the screening process.

- Screening and interview process: Number of interview rounds and assessment methods, which can extend the time-to-fill.

Historical data:

- Past benchmarks: Historical time-to-fill data for similar roles within the organization or industry benchmarks.

- Trends over time: How time-to-fill metrics have evolved due to technological changes, recruitment practices, or market conditions.

Outcome data:

- Quality of hire: Tracking the success and retention of hires can provide insights into the effectiveness of the time-to-fill metric as a performance indicator.

- Offer acceptance rate: The ratio of offers made to acceptances can indicate the competitiveness and attractiveness of the offer.

Compare and improve time-to-fill metrics at a granular level

Effectively reduce the hiring time in your organization! Unlock the power of smartHire to compare and refine time-to-hire rates, salary ranges in a particular area, and more — by role and location.

Leveraging future job profiles for enhanced recruitment strategies

Here’s the forward-looking approach we offer from HRForecast. Understanding and integrating prospective job profiles into your hiring strategy can significantly improve your ability to attract and select the best talent. Here’s how organizations can make the most of prospective job profiles at different stages of the hiring process using HRForecast solutions:

Stage 1: Challenge the hiring manager

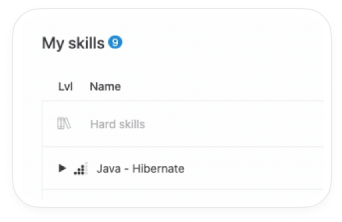

Cultivating an awareness of future skills and adopting a strategic approach to recruitment is critical for organizations seeking to stay ahead in a rapidly changing workforce. By leveraging insights from future job profiles, hiring managers can shift their focus from past requirements to future growth needs, disrupting the traditional hiring cycle. Encouraging a mindset shift to consider potential role evolution aligns talent acquisition with strategic business goals. This approach attracts the right talent and builds the sustainable and forward-looking workforce needed to meet future challenges and achieve the organization’s long-term success. Below, the illustration shows how smartData can help to hire managers to explore future jobs.

Stage 2: Create your job post

Relevance and clarity are key; tailor job posts to highlight technologies and skills critical for the future. For instance, if a future job profile for a data scientist highlights the importance of Salesforce, and your company uses this technology, make it a focal point in your job description. Moreover, aim for conciseness and focus. Since future job profiles may list extensive skills and duties, prioritize those most relevant and attainable in the current job market to ensure your job postings are realistic and targeted.

Job post structure:

- Company overview. Clearly state your mission and values.

- Role description. Detail the responsibilities and required skills.

- Benefits. Highlight what candidates gain by joining your team.

Below we’ve given an example of building a skills taxonomy. To create it, we can break down the key elements mentioned in a structured format that outlines important job components, specifically for the Salesforce-focused data scientist role. Here is an example of how this taxonomy might be structured:

Stage 3: Select the candidate

Efficient selection, by focusing on candidates who best match the future job profile, streamlines the recruitment process and improves the quality of hires. This is complemented by skill fit analysis, which identifies candidates with the best alignment to the required skills and future job needs, optimizing the fit between the role and the talent.

Integrating internal staffing allows organizations to maximize the use of resources and reduce costs through existing workforce capabilities. This strategy promotes employee retention and accelerates recruitment because internal candidates are familiar with the company’s culture and procedures.

Optimizing recruitment: using job libraries and deep analytics

Strategic use of job libraries is key to creating a structured repository of current and future job profiles, thereby standardizing job descriptions and expectations across the organization. This initiative is key to maintaining alignment and ensuring all roles align with organizational goals and market realities.

An important aspect of this strategy is a thorough analysis of key performance indicators (KPIs), including time to hire and salary benchmarks, further broken down by job title and location. Such metrics offer invaluable insight to set realistic expectations and competitive bids in the job market. Additionally, understanding the nuances of salary trends, job complexity, and specific job demand dynamics is essential to developing competitive and attractive offers that ensure the organization remains an employer of choice.

Defining the necessary digital skills for future roles is becoming increasingly crucial as digital transformation accelerates. This foresight and a proactive approach to workforce planning significantly enhance staffing efforts, enabling organizations to navigate and thrive amid changing industry demands.

Adopting a predictive perspective inspired by HRForecast analytics empowers recruiters to move beyond traditional hiring paradigms. This enriched knowledge base makes it easier to attract and select candidates who can adapt to future challenges and improves recruitment strategies. By skillfully managing job libraries and deploying detailed KPI analytics, organizations can build a workforce that is ready for tomorrow’s challenges and reflects strategic foresight and adaptability, thanks to HRForecast’s expertise.

Implementation and data utilization

The journey begins with setting clear objectives for the benchmarking process, such as reducing hiring times and improving the quality of hires. This clarity in goals enables a focused approach to gathering comprehensive data that encompasses all relevant aspects of the role and location. Through meticulous statistical analysis, organizations can identify trends, outliers, and areas ripe for improvement, thereby gaining a deeper understanding of their time-to-fill metrics on a micro level. This granular insight is pivotal for devising more targeted strategies that cater specifically to the nuances of different roles and geographic locations.

Continuous improvement through innovation

Moreover, adopting data-driven recruitment strategies, including integrating artificial intelligence and machine learning, marks a significant advancement in streamlining candidate sourcing and selection processes. By building robust talent pipelines and enhancing employer branding, companies can attract and retain top talent more effectively, thus significantly reducing time-to-fill. These innovative strategies are not mere one-time adjustments but part of a continuous monitoring and improvement cycle, ensuring that recruitment practices remain agile and responsive to the evolving job market.

Strategic recruitment practices

The essence of these efforts lies in understanding the micro-level nuances of time-to-fill, from industry and role-specific variations to geographic and international considerations. This nuanced understanding enables organizations to fine-tune their recruitment strategies, leveraging detailed data analytics and strategic practices to attract talent within optimal timelines.

Summing up

HRForecast offers a strategic approach to today’s recruitment challenges, focusing on improving time-to-fill, a critical factor in organizational performance.

By integrating comprehensive data analysis, innovative hiring methods, and predictive modeling for future positions, HRForecast aims to improve the hiring process by making it more efficient and streamlined. For example, solutions such as smartHire and the ROI calculator are designed to provide a deep understanding of hiring practices, allowing companies to fine-tune their strategies for different roles and geographies.

This methodology not only simplifies the hiring process but also aligns recruiting efforts with the evolution of the nature of work. Would you like to try these solutions in practice? Book a call with us; we will help you understand benchmarking data for time to fill.

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810