How to create an incentive compensation plan: understanding the “Incentive theory of motivation”

As a child, whenever you got good grades in school, you likely would rush home as you were promised a bar of chocolate or your favorite toy in return. As an adult, you may have forced yourself out of bed to go to the gym because you wanted to fit into your old pair of jeans. Do you notice a common force behind these actions? According to the “Incentive theory of motivation” developed by Burrhus Frederic Skinner, people’s actions are motivated by the incentive they will receive for doing it right.

This theory often holds true in the workplace, where employees often try and work harder on a project if they believe it’ll lead to a positive quarterly review or promotion.

What is an incentive compensation plan?

An incentive compensation plan is a cash or non-cash form of compensation that an employee earns on top of their regular, base salary. This plan is strategically formulated to motivate the performance or targeted achievement of the employee and is usually variable.

These incentive compensations come in forms like straight commissions, bonuses, prizes, non-cash rewards, awards, and verbal recognition. The basic rule of creating an incentive compensation plan is to align employee effort with corporate goals. However, maintaining this alignment can be difficult generally because people respond differently to offered incentives. While one employee will best respond to cash-based incentive compensation, others may find it exciting to aim at winning a paid vacation.

The question that then arises is: “How to make an incentive compensation plan that keeps all the employees in an organization happy and motivated?”

How to create an incentive compensation plan

An incentive compensation plan is a scary beast for many companies. After all, it is an expensive investment, so you naturally will be worried if it works out or not. However, there is a sweet spot where you can ensure that your incentive compensation plan directly aligns with your organization’s goals. Read along to understand how you can create an incentive compensation plan that contributes to your organization’s overall growth and performance.

Start by aligning incentives with your business goals

The first step should be to prioritize your business goals and then represent them in the incentive compensation program. Depending on the type of planning model your organization generally uses, be it from bottom-up or top-to-down, it is ideal to have your goals forecasted for the upcoming year. By laying down the goals and priorities, you’ll be able to lay down a foundational structure for the incentive compensation plan.

The goals here can be targeted for company-wide performance wherein you want to instill a spirit of cooperation between employees so that their performances are linked together. Or, alternatively, your goals can be more focused on motivating individual employees. In that case, you will need an incentive compensation plan with an appropriate criterion for some, and organizational performance for others.

It’s important here to talk a bit more about determining the goal you want to achieve. It could that you have some idea of a desired improvable or attainable goal. Make sure you analyze these ideas to ensure that you have an appropriate environment that provides employees with the tools they need to reach them. Be specific about your goals, rather than simply wishing or hoping. After all, when it comes to incentive compensation, it’s not what you wish for, but what you pay for, that you will get.

Research different types of incentive compensation plans

It can be challenging to figure out the type of incentive compensation program that works as an incentive for employees to go the extra mile. Your best bet is to evaluate the different variants through trial and error. Below are the six main types of incentive compensation plans a company can choose from. You can select the one that is most commonly sought after, or mix and match.

- One-time bonuses. These come in the form of yearly bonuses companies give to employees for achieving preset targets.

- Profit-sharing bonuses. In this plan, employees get a share of the company’s annual profits. The employees are paid in either cash or stocks.

- Shares of stock. To help employees to stay with the company for longer-term, stocks are offered with criteria that incentivize employees to remain with the company.

- Retention bonuses. These bonuses are offered to employees for remaining with a company during critical economic times and business cycles.

- Non-cash incentives and recognition. Some people thrive off recognition for their hard work and achievements. One example of this is an “Employee of the Month” program.

- Career development Incentives. The feeling of stagnation in career and personal development comes to every employee at some point. At such times, employees can be offered training and development outside of their day-to-day job, as an incentive.

Determine the participants for the incentive compensation plan

Once you have the goals, clearly define which roles in the organization will focus on accomplishing them. Map out the department on which you’ll need to focus on, and develop quotas that will fit those needs.

Another point to remember here is to not overlook human nature when selecting employees for the program. Eventually, it will kick in. Employees can generally be counted on to do things that benefit their own self-interest. (And no, that doesn’t make them mercenaries, but makes them more human.)

Set clear performance goals

When it comes to setting performance goals for employees, there is one single secret ingredient to keep in mind: Keep it simple, State the performance goals in the simplest terms and support them with valid information that can be clearly quantified. In fact, the fewer goals, the better the program will work. If you’ve set more than 5 goals, you’ve likely gone too far.

Design the potential payouts to ensure that you can afford them. You should be ready to pay for incremental improvement, not just for final goals. Let’s say you’re thinking of implementing a gain-sharing plan whereby the employees will share in all financial improvements from a predetermined threshold. You’ll need to decide whether you pay out near the historical performance levels or several percentage points below that. The more realistic your rewards, the higher chances that your employees will respond positively because then they can easily understand what they’ll receive in return for their extra efforts.

Determine the plan’s logistics

Every single part of the incentive compensation plan must have a start and end date. These include:

- Dates of incentive consideration,

- Payout dates, and frequency

- List of what is and isn’t considered a part of the performance

- Plan revision procedures

- Termination payouts

- Effective dates for the beginning and end of the plan.

By determining all the logistics at the beginning, you can receive two major benefits. One is that you’ll be able to review the cycle between goals and performance automatically. Secondly, the plan will work more towards making all employees work on performing better, rather than giving them incentive compensations as an entitlement.

Communicate in an easy-to-understand manner

Simple and plain language is not boring or dumbed-down. The power of effective and thorough communications in the workplace is often underemphasized. When you communicate with the participants of the incentive compensation program in an easy-to-understand manner, you’ll get their full attention, and they will have ample knowledge to successfully achieve those set targets necessary to reach various incentive levels. Use plain, easy-to-understand English when explaining what the plan is designed to do, and what your expectations are for their performance within the plan.

At the same time, keep the communication brief. It can be tempting to go on and on about how the targets can be achieved. For example, if you have 4 pages of an incentive compensation plan, then the key content there is likely not more than a page and a half. Be direct and to the point so that the participants know who does what and who gets what in return. You can also inform them of the terms that can lead to them losing their incentive when things go wrong.

Measure the success and/or failures of the plan

After you have finished the first cycle of the incentive compensation plan, it’s time to evaluate the success or failure of the plan. Your next plan can only be improved if you know what worked and what did not. Compare the payout for incentives as compared to expected results, to check the plan’s performance in real life. By applying the proper scrutiny, you can make sure that the money spent on the incentive compensation plan is working properly for both the target participant and your organization.

The right platform can help you determine the best employee incentive compensation plan for your business.

To learn more about how HRforecast is already helping businesses, contact us today!

Common incentive compensation plan mistakes to avoid

While creating an incentive compensation plan is not based on intuition, it is not rocket science either. Having said that, getting the incentive compensation plan right is essential to the success of an organization. Below are some common mistakes that initially may not seem harmful, but will hinder the growth and performance of your employees.

- Using the same plan over and over again: By using the data from the initiation of the first plan, you must re-evaluate the plans in-depth, take the best parts, and change the weak points to create even more effective incentives.

- Failing to benchmark against competitors in the same industry: By benchmarking above what competitors are offering, you can optimize your incentive compensation to attract and retain top performers.

- Over-complicating the incentive compensations: When the plan is simple and concise, it will ensure that the employees have a clear understanding of what expectations they have to meet, and how they can benefit from achieving the targets.

- Using the same incentives for all roles: It’s wrong to expect every single employee in the company to hit the same targets when their jobs are different. Therefore, it’s vital to tailor incentives to each position’s responsibilities.

- Manual evaluation of the plan: Excel spreadsheets are a thing of the past and are messy. They’re more prone to errors, and will not allow you to scale your success. Automating the process will make your team’s performance review more efficient and allow incentive optimization and strategic planning.

Software solution by HRForecast

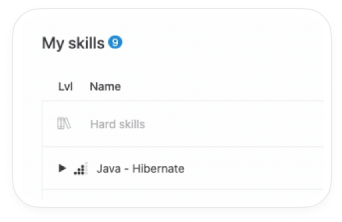

We understand that when it comes to finding software solutions to analyze your team’s performance, it can be challenging to know where to get started. The smartPeople software allows you to consider the different capabilities of your employees, such as their skills, tasks, and performance, which you’ll need to take into account to align decision-making across multiple departments for an optimized workforce.

Book a demo to learn how you can make the most out of smartPeople to align your employee goals with those that benefit your organization!

Stay up to date with our newsletter

Every month, we’ll send you a curated newsletter with our updates and the latest industry news.

info@hrforecast.de

info@hrforecast.de

+49 89 215384810

+49 89 215384810